|

| | Canadian Real Estate / Mortgage Glossary : T| Results found: 43 | Page: 1 of 3 |

Takeout Mortgage Loan

A long term mortgage loan that is advanced to borrower on completion of construction or in compliance with any other conditions in the loan commitment. The funds are normally used to pay off or take out the construction lender.

|

Tangible Personal Property

Assets other than real estate that physically exist. Business equipment and vehicles are tangible personal property. Assets such as stock certificates and franchises only represent value and are therefore intangible property.

|

Tax Deduction

An expense that governments allow you to subtract from your income before computing your income tax.

|

Tax Deferral

The postponement of taxes to a later year, usually by recognizing income or a gain at a later time. Remember, this only delays your tax liability; it doesn't eliminate it.

|

Tax Exempt

Income that is not subject to tax. Income exempt from federal tax may, however, be subject to provincial taxation.

|

Tax Liability

The total amount of tax you owe.

|

Tax Lien

A claim, or obstacle, to the sale of property because of unpaid taxes. The property's title can't be transferred until liens are paid.

|

Tax Sale

A government sale of property to recover unpaid taxes.

|

Tax-sheltered

A tax shelter is a savings/investment plan which offers significant tax savings.

|

Taxable Income

Adjusted gross income less itemized or standard deductions, less personal and dependent exemption amounts.

|

Tear-down Condition

A house that is bought so it can be razed to make room for a newer house; usually located in a spectacular setting.

|

Teaser Rate

Often called the introductory rate, it is the below-market interest rate offered to entice customers to switch credit cards or lenders.

|

Tenancy by the Entirety

Ownership by spouses in which each spouse owns an undivided interest in the entire property. When one spouse dies, the other has title to the entire property.

|

Tenancy In Common

Ownership of ad by two or more persons: unlike joint tenancy in that interest f deceased does not pass to the survivor, but is treated as an asset o the deceased's estate.

|

Tenants in Common

Ownership by two or more people in which each person owns an undivided interest in the entire property and all have equal rights to use the property. When one tenant in common dies, that person's interest may be sold, mortgaged or transferred to another in a will.

|

Tenure

The act, fact, or condition of holding something in one's possession such as real estate. A period during which something is held.

|

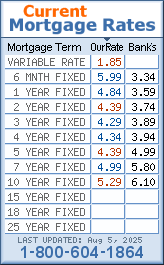

Term

The length of time you commit to repay a lender or bank at an agreed upon interest rate and payment schedule. The interest rate usually remains constant during this term unless the commitment states otherwise. For example, a five year fixed rate mortgage has a term of five years.

|

Term Deposit

An investment product in which you deposit a fixed sum of money for a set period of time and are paid interest.

|

Term Loan

A loan intended for medium-term or long-term financing to supply cash to purchase fixed assets such as machinery, land or buildings or to renovate business premises.

|

Third-party Originator

One who takes all or part of the mortgage application and transfers or sells it to a lender.

|

|

|