|

| | Frequently Asked Questions| Results found: 24 | Page: 1 of 2 |

How long does it usually take to receive a reply? How long does it usually take to receive a reply?

Usually within two hours & never more then 2 business days -- If you haven't heard from us by then please call 1-888-818-4262 Usually within two hours & never more then 2 business days -- If you haven't heard from us by then please call 1-888-818-4262

|

Where in Canada do you lend? Where in Canada do you lend?

Everywhere -- The Canadian Equity Group is a National company. Everywhere -- The Canadian Equity Group is a National company.

|

Do you offer commercial mortgages? Do you offer commercial mortgages?

Yes Yes

Click here to visit website.

|

How does debt consolidation work? How does debt consolidation work?

For additional information click here.

|

What is required to obtain a first mortgage? What is required to obtain a first mortgage?

For additional information click here.

|

Do you offer employment opportunities? Do you offer employment opportunities?

Yes - Just upload your resume as a Microsoft Word Document. Yes - Just upload your resume as a Microsoft Word Document.

Click here to visit website.

|

Do you have to own a home in order to get a debt consolidation loan? Do you have to own a home in order to get a debt consolidation loan?

Yes Yes

For additional information click here.

|

Do you do pre-qualifying mortgages? Do you do pre-qualifying mortgages?

Yes Yes

Click here to visit website.

|

Do you finance rental property? Do you finance rental property?

Yes Yes

Click here to visit website.

|

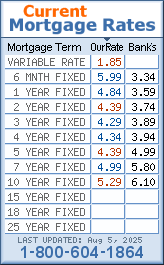

What is the current prime rate? What is the current prime rate?

You'll find the answer on our variable-rate mortgage page! You'll find the answer on our variable-rate mortgage page!

For additional information click here.

|

Is there a benefit with going to a bi-weekly mortgage payment? Is there a benefit with going to a bi-weekly mortgage payment?

Yes -- If you pay your mortgage every two weeks, you will gain the equivalent of one extra monthly mortgage payment a year; thus allowing you to pay off your mortgage faster. Yes -- If you pay your mortgage every two weeks, you will gain the equivalent of one extra monthly mortgage payment a year; thus allowing you to pay off your mortgage faster.

|

Do you provide mortgages for Agricultural properties? Do you provide mortgages for Agricultural properties?

Not at this time -- Most banks will not place mortgages on properties that are zoned agricultural. The best recommendation is to apply through farm credit. Not at this time -- Most banks will not place mortgages on properties that are zoned agricultural. The best recommendation is to apply through farm credit.

Click here to visit website.

|

What is the difference between Co-signer and a Guarantor? What is the difference between Co-signer and a Guarantor?

A Co-signer is placed on the mortgage and is registered on the title. A Co-signer is placed on the mortgage and is registered on the title.

A Guarantor signs a document that personally guarantees the mortgage.

Most banks will do both. Some banks prefer that co-signer live on the property.

|

Do I need mortgage life insurance? Do I need mortgage life insurance?

No. The only insurance banks can legally force you to get is fire insurance. Mortgage life insurance only covers the remaining balance of your mortgage. Ontario Equity recommends that you purchase normal term life insurance with a loss payout that will cover the current value of you home, not just the balance of your mortgage. No. The only insurance banks can legally force you to get is fire insurance. Mortgage life insurance only covers the remaining balance of your mortgage. Ontario Equity recommends that you purchase normal term life insurance with a loss payout that will cover the current value of you home, not just the balance of your mortgage.

|

Does Ontario Equity use my email for spamming purposes? Does Ontario Equity use my email for spamming purposes?

No No

For additional information click here.

|

Does Ontario Equity release my information to third-parties? Does Ontario Equity release my information to third-parties?

In order to process your request, the financial institutions or service providers we work with will need certain information about you. We ensure your information is transmitted over a secure data stream and is housed on a secure server. Your non-public information is not sold or released to any third-party marketing companies, nor is it used for any other purposes other than the services you request. In order to process your request, the financial institutions or service providers we work with will need certain information about you. We ensure your information is transmitted over a secure data stream and is housed on a secure server. Your non-public information is not sold or released to any third-party marketing companies, nor is it used for any other purposes other than the services you request.

For additional information click here.

|

Is it possible to get a mortgage through Ontario Equity, even though at this time I am not a Canadian resident? Is it possible to get a mortgage through Ontario Equity, even though at this time I am not a Canadian resident?

Yes -- Some conditions do apply (i.e., minimum 25% down, good credit rating). Yes -- Some conditions do apply (i.e., minimum 25% down, good credit rating).

For additional information click here.

|

What is a Mortgage Broker? What is a Mortgage Broker?

Mortgage Brokers are independent, trained professionals licensed to represent and provide you with the best advice for your mortgage needs. Ontario Equity mortgage brokers are members of the Canadian Institute of Mortgage Brokers and Lenders. Mortgage Brokers are independent, trained professionals licensed to represent and provide you with the best advice for your mortgage needs. Ontario Equity mortgage brokers are members of the Canadian Institute of Mortgage Brokers and Lenders.

|

Do you charge any fees? Do you charge any fees?

Over 95% of all Ontario Equity client's pay no fees! In some cases fees maybe charged for securing commercial and second mortgages. Over 95% of all Ontario Equity client's pay no fees! In some cases fees maybe charged for securing commercial and second mortgages.

|

What is your email address? What is your email address?

info@canequity.com info@canequity.com

For additional information click here.

|

|

|